Shinoken’s Q2 results were good, but not important since the company will likely be taken private for JPY 1600 per share.

This is not investment advice. Please read the disclaimer. I might own discussed stock(s) currently or at a later time. I might transact in any securities at any time.

I am absolutely clueless about special situations in general and particular Japan. Anyway, it is interesting to think about the question if an increased bidding price is likely?

- The JPY 1600 per share offer equals to low P/E, P/B multiples.

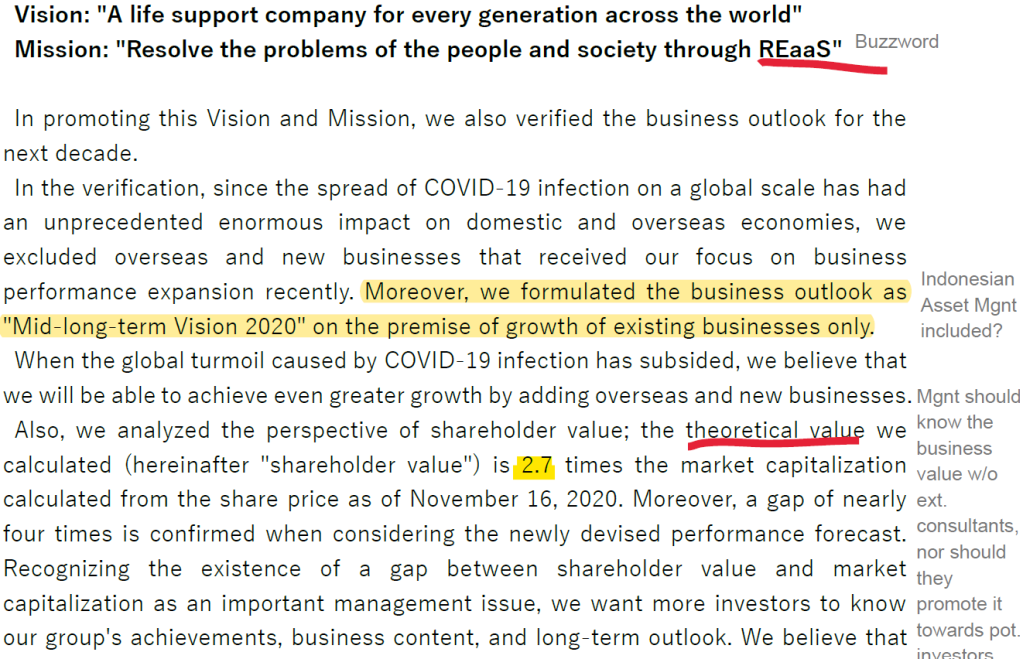

- Two years ago, Shinoken’s vision document included a section concerning the (fair) value of the company. An external opinion concluded that the business was worth 2.7x times the price of Nov 16, 2020 which was coincidentally at JPY 1099, where it was a few days ago before the announcement.

- Earlier offers were for 1300, 1425, 1520 JPY, before the final offer of 1600 (+23% from initial bid). Thus, any higher offers from Integral appear unlikely.

- This means, additional upside could come from other bidders, but, since Mr Shinohara has entered into an agreement with Integral, other offers appear unlikely, too, especially considering ‘(4) Market Check’ was carried out. Though, any other interested third parties might come up.

The Tender Offeror has set the minimum number of shares to be purchased in the Tender Offer to 21,509,600 shares (ownership ratio: 62.87%), no maximum is set. (http://www.jpx.co.jp/english/news/1023/20220810-12.html)

- (1) If the takeover bid is completed with the bidder acquiring 90% or more of the total voting rights of the Company, the bidder will demand the sale of all the remaining shares (squeeze out); and

- (2) If the takeover bid is completed with the bidder failing to acquire 90% or more of the total voting rights of the Company, the bidder will demand a reverse stock split, resulting in all minority holders having less than one share, thus getting liquidated.

- (3) if not successful (<63%?): the acquirer must not buy any shares (for 1600 each) but what happens then? What is the probability for the bid not being successful? The share price might come down, but would likely not fall all the way to 1100. What is the probability?

- I guess the tender is quite likely to succeed, maybe at below 90% (2). Japanese investors/funds might be pleased by the offer and do not want to upset any management and thus agree to sell (least resistance).

- Notable foreign investors are roughly interactive brokers/many Pabrai fans/cloners? (8.2%), UBS (2.2), and about 6 with holding above 1%, for a total foreign ownership of 22.5%. Would the aggrgate of some of the international investors be enough if someone is pushing?

- I do not know where such a liquidation via the reverse-split would take place (<<1600?), and thus i think i will sell.

I bought my shares in the range of JPY 996-1285 per share between Feb’21 and Feb’22 so 1600 is a nice return + dividends, even though the bid seems not expensive, maybe not even fair. Since the JPY depreciated against EUR, my EUR returns are lower. Worse, in early AUG 2021, I sold my small Koshidaka position and added to Shinoken instead, for a lower return.

Fielding outcomes. On the positive side, I can take this takeover as validation that it was a good investment (and/or a bit of luck via the take private within an outcome fielding framwork).

I planned for this being a long-term investment. And as in other instances i realized it is easier for me to hold on to investments when their share prices come down when I created some kind of model. This is a lot of work, but helps to track a thesis (it might also be pure bias: look no further than FLOW NA).

thank you for the update

LikeLiked by 1 person

Sorry to hear. Norbert Lou made a purchase in 13F that is interesting 🙂

LikeLiked by 1 person