Oriental Watch released results a few dasy a go, so I can finally publish this piece.

The Thesis Tracker was in my head for a long time. I probabaly read about its concept or something related on various occasions, but this piece is what I found in my emails. It includes the concept of facts vs expectations. Tracking facts without adjusting them for cause and effect (think external factors: pandemic, inflation) can help us to tackle our biases, without adjusting for external causes).

To track the most important variables for each of my investments over time to check if my investment thesis is on track is the ultimate goal. Ideally, my investment thesises can be proven wrong, making it easier to abandon an investment or getting a clear signal that a re-evaluation is needed. Doing a re-evaluation might also be necessary if key variables develop very favorable (meeting a very bullish case or even better). In this case an investment’s price might have accelerated beyond my original fair value range, but selling would still be a mistake …

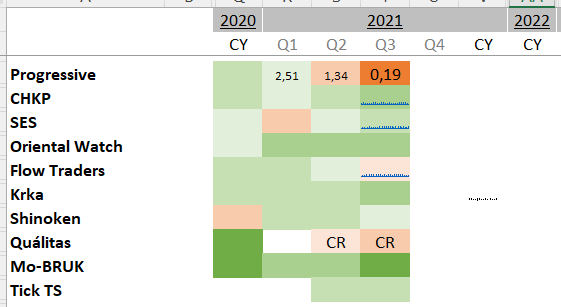

I planned this Thesis Tracker for some time and even did sporadically use it, but Q3 2021 is the first time I pursued it more seriously. First big benefit: I was forced to get a clearer picture of my underlying thesis for my investments. I still have to do some work on which metrics to track and what ranges to expect, but I think from here on it will only get better… Often, my thesises were not that precisely defined. I plan to change that.

My investments are mostly on track. Exceptions exist mostly related to unprecedented inflation. Inflation and normalization trends in drivers’ mobility result in higher combined ratios or CRs for PGR and Q*. FLOW’s Americas business disappointed.

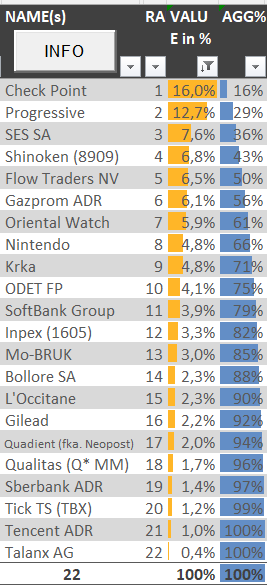

I exclude many positions like cyclical Energy (Gazprom, Inpex), SOTP plays (ODET, BOL, SBG) and positions where I do not have a detailed/firm thesis (Gilead, Quadient, Nintendo). Maybe that will change. SOTP plays might indeed make a lot of sense to track, especially if certain catalysts were part of my original thesis. My current portfolio is below:

No performance review. Probably you noticed that I did not squander any words about performance. And that is intended. (Further, it would depress me if I compared my results with fintwit 😉 Then again, I locate myself pretty much in the defensive corner. Of course, long-term investment might be THE perfect excuse for short term underperformance, and further, long-term consists of many short-term periods, if we want to view it that way). For the time being I plan to review performance on an annual basis only, let’s see if I will change my mind …

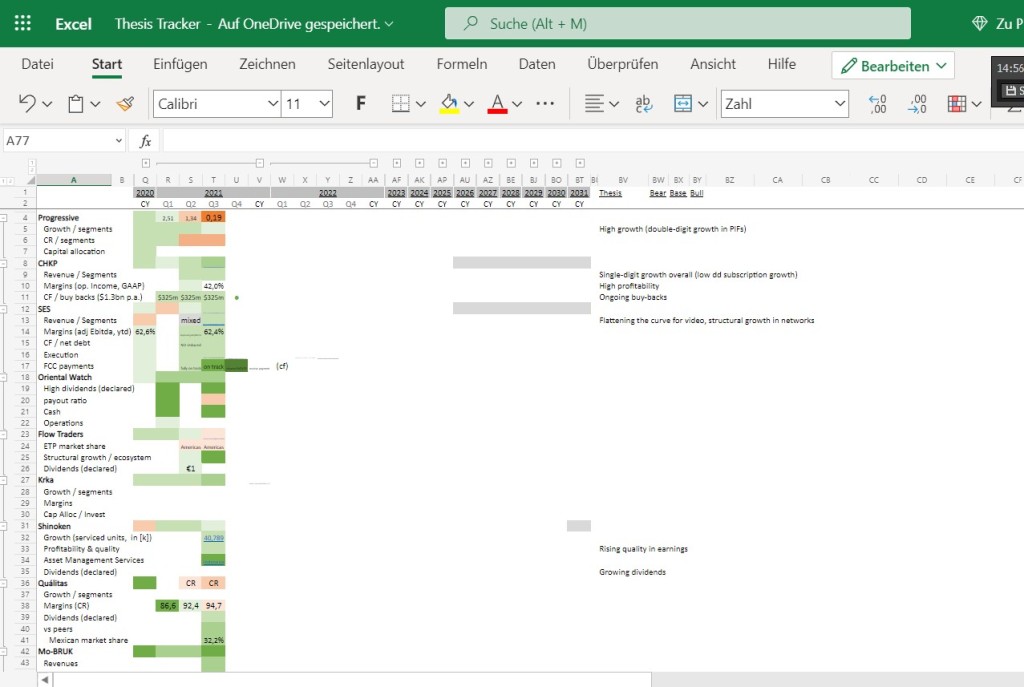

Add: Please remeber that this is still a work in progress. I started to define some metrics/issues to track per company within my excel file (excel online within onedrives improved a lot, even data-grouping works fine now). Here is use simple colour codes (not excatly defined yet). I switched to one note and think this is a good setting for me. Grey areas roughly indicate that a thesis should work until then, i.e. CHKP buys loads of shares, increases top line growth a few %-points. SES deleveres a lot through FCC payments … I still have to define my thesis (ranges) for most investments

Im down 4% (BABA keeps falling) overall but I would have to naive to think the market will realize value in a year. Hard to judge am I delusional or on the right path. Weathering a few >80% crashes in crypto makes the pain of value stocks is great. I sleep great with a 4% loss even as S&P500 is doing well 🙂

LikeLike

I have seen Silver Ring (Gary Mishuris) use this concept in his quarterly letters and like the idea.

LikeLiked by 1 person

The link is him on The Acquirer’s Multiple. I also read his write-ups, so it might be possible that I read about the subject on various occasions but from a single source (Gary Mishuris)

LikeLike

I am curious to see more about this tracker.

Care to share the file with us?

LikeLiked by 1 person

Hi Dillon.

I added two pics.

Nothing special here, and still work in progress, but I like my current set up (more detailed in one note, colouring in excel tracker)

LikeLiked by 1 person

Nice, thanks!

LikeLiked by 1 person