With Trade Republic, Germany has its own robinhood – though the app’s gamification /products /users and stimuli to gamble instead of investing at the financial markets is not as extreme as its American role model Robinhood. But, Germans start to invest again …

This is not investment advice. Please read the disclaimer.

I might currently or at a later point in time own shares (economic interest) in mentioned or related companies.

More German investing in stocks is a good thing, I think it’s about time that more Germans invest their hard earn cash in a better way (traditionally Germans hold vasts amounts of e-cash at banks – even in a zero/negative interest world). This new trend could be overextended and much too much too fast and might end badly again. The Telekom stock (DTE GR) might serve as an example which many Germans bought at its peak

(I bought DTE twice well below todays level).

I wrote about Trade Republic before:

I liked tick TS much more than Sino, but did not buy it in September. It has a steadily and profitably growing business and executes very well (ad-hoc news Dec 15th, in German). Many German companies profit massively from the new German lust to buy stocks. The stock (LUS GR) of Lang & Schwarz (please translate the company name if you long for a laugh) which executes trades for TradeRepublic is up more than 400% in one year. If LUS’s service breaks down, which happens when volatility is a bit high, Traderepublic switches over to Tradegate (T2G GR) which seems to have more stable systems. T2G is up more than 200%. When I buy/sell securities via my main broker I usually use Tradegate.

- Traderepublic just announced to launch in France.

- (while I wrote this post it did launch)

Tick TS is ‘only’ up 60% over one year and profits more indirectly from the new trends in Germany. It offers trading software (and infrastructure) and its revenues are partially load-dependend, so it is proditing from more trades. If the stock market craze turns out to be short-lived, than tick TS should still be a very profitable business with good growth prospect nonetheless, but a bit less so (some clients deferred projects due to the pandemic). They have valuable client relationships and deliver high-quality software /updates for them, sometimes due to regulatory requirements (read enforced).

Revenues

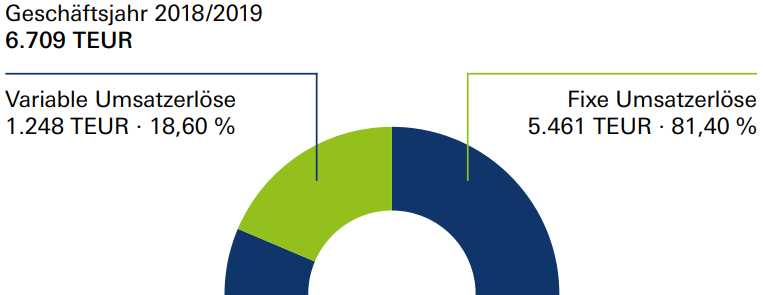

Tick’s revenues grow nicely and are from licences and hosting, projects, and trades.

Tick distinguishes between one-time vs recurring and variable vs fixed revenues. One-time revenues mostly result from project-based work and can result in an increased ‘base’ for generating future (recurring) revenues. Variable revenues were ~20% in FY 18/19 and 19/20, but recently increased towards ~30%, according to statements at MKK in Dec, resulting from

- load-dependend hybrid billing models with clients, and

- currently higher trading activity

Further growth should be reasonably certain since the company wants to hire four additional employees, according to statements at MKK. The growth opportunities are there.

A view on valuation

Tick TS earned €2.01 per share in FY 19/20, ending Sep 2020. Based on trailing EPS and its current share price of €37, Tick sports a 18.4x P/E resulting in a dividend yield of 5.4%.

Looking at H1 FY 19/20 numbers and results for FY 19/20 (ad-hoc news Dec 15th) we can observe a strong implied acceleration in H2 19/20. Calculated annualized EPS for H2 are ~ €2.40, indicating a 15.4x P/E. Assuming ongoing high trading activity and neglect higher personnel expenses (+4 employees, careers) for the moment, this valuation looks very attractive taking into account further structural growth (ex. variable revenues).

Based on the above trailing valuation ratios, the company does not look too expensive. At least if you share the view that this is a higher quality company with above average growth prospects.

Assuming a discount rate of 8% and a EpS (or dividend) growth rate of 10% until 2025, a simple DDM results in the current price of €37. The trading activity since September is up! Near-term results should easily show higher growth rates with the ongoing retail trading craze driving load-dependend fees and product developments. If the market crashes, load-dependend fees could dive (at least temporarily). Future result can be better or worse, but the above serves as a reassuring observation.

How will the future look?

As always, we do not know! But we can look at various plausible scenarios. According to statements at MKK from Dec 8th 2020, variable revenues increased to 30% of total revenues, driven by higher trading activity and hybrid-sales-models. I can think of a few plausible scenarios.

- Retail trading frenzy ebbs in a few months with reopening but Germans keep investing in stocks for various reasons – there are plenty.

- Retail trading frenzy ends badly within a few months – a last hurrah.

- Tick grows a lot more – what are new hires for?

- Tick shrinks – just an unlucky cyclical peak

For all scenarios I will assume the following (if not stated otherwise):

Higher personnel costs. Adding four employees (during FY 20/21?) will lead to increases. Additionally, such personnel is scarce and knows that, so they do not come cheap. Average personnel costs per employee were ~131k in FY 18/19 (higher wages for new hires, general wage adjustments, and bonuses). Personnel costs were up 7.6% from the prior year. Tick’s career website currently shows three open jobs. I assume total personnel costs of €3.5m in FY21/22 up 40% from FY 18/19. Afterwards, they grow in tandem with …

Increasing other operating costs. OpEx (including personnel) is assumes to be 30% higher in FY 21/22 vs 18/19 and increases at an annual rate (3%) below top-line growth, resulting in increasing margins.

Growing underlying business. Fixed sales are assumed to continue their strong growth with 10% p.a. in current and next FY and slower (5%) thereafter.

Futher I assume a Tax rate of 30% and full distribution of profis to shareholders. As standard valuation parameters I apply a discount rate of 8% and a terminal growth rate of 3% after FY 28/29.

Scenario 1

As far as Germany is concerned, the current trading activity is probably the highest ever with neo-brokers running on full speed giving you always the next best idea when releasing their daily ‘top-stocks‘. With this backgrund, the below assumptions for variable sales might seem too low

- Variable revenues were €1.19m in the 6m-period March to Sep 2020

- based on 30% variable sales of total H2 sales of €3.95m.

- Assuming a (too modest?) increase of 30% of these H2 numbers results in

- €3.1m variable sales in FY 20/21

- Variable sales of €2.0m in FY 21/22 seem currently rather conservative

- compared to €2.2m in FY 19/20

- and will grow at 3% thereafter

Fair value per share comes in at €47 for scenario 1.

Scenario 2

If and when the stock market crashes I guess it is more than likely that the market segments most favored by novice investors (or app users) will crash even more than the broader market. They would probabaly realize that ‘stocks only go up‘ isn’t true after all and tap, tap tap the (panick) sell-button very often. some might never play the stock market game again. But who knows if we are in a bubble or when it ends … During a crash, trade volumes could experience one last explosion of course with novice investors or users surrendering and selling everything.

There is another reason for a near-term spike in retail trading activity and thus variable sales. The regulators could step in and they could end the recent stock market adventures rather sooner than later (with users returning to the slot machines). In this case, the new neo-brokers that are so easy to use tap, tap tap during a tram ride will likely be affected much worse than more established and older industry players (probably fixed revenue models?).

In either case (crash or regulation), trading activity per user should come down in any reasonable long-term scenario (maybe my imagination is not good enough…). Regulations gets a lot more likely, after a crash did happen – that’s is how politics (sadly) work most of the time.

- Variable revenues were €1.19m in the 6m-period March to Sep 2020

- based on 30% variable sales of total H2 sales of €3.95m.

- Assuming a (too modest?) increase of 100% of these H2 numbers results in

- €4.74m variable sales in FY 20/21

- Variable sales of €2.0m in FY 21/22 (vs €2.2m in FY 19/20)

- €1.5m in FY 22/23

- and will grow at 3% thereafter from this lower base

- reaching €1.8m in FY 28/29

- well below €2.2m in FY 19/20

- reaching €1.8m in FY 28/29

This scenario still results in a FVpS of €41.60.

I do hope that this scenario does not happen and that Germans start investing for the long-term instead, but I guess the odds are not in my favor here. I rather believe, it will end badly (again) for the most part of new stock market investors participants sooner or later …

Scenario 3

How could Tick grow a lot more? Even if trading activity per user goes down (maybe it doesn’t), there is still a vast number of new users that could potentially begin investing in stocks. This does not have to be via noe-brokers. It coudl happen in a more traditional (and probably sustainable) way. They might just automatically buy ETFs on a monthly basis and barely look at any quotes. Due to recent trends, more of Tick customers customers want to update there technology and offer more modern solutins including apps. Tick can cater to that natural demand (and growth) making good use of its new employees.

Tick’s revenues grew 13.3% p.a. over the last three years and with 9.5% for the last five years. Scenarios one and two assume growth rates below that (besides current FY). Any higher growth would result in high upside. Assuming fixed sales growing 20% next year, 15% and 10% thereafter with a deacceleration towards 5% p.a. results in a FV of €70. How likely is this high growth scenario? I don’t know. But it could be more likely than the next one.

Scenario 4

Sure, it’s possilbe that Tick grows a lot less than assumed above, but I do not think it is all that probable. Tick has a lot going for it, many talewinds and a strong execution. But, anything could go wrong: key person risk, exploding costs (scarce personnel), a project going wrong, emerging far superior competitor, customrs leave or go broke, whatever. How likely is it? I do not know, but scenario four could account for one of those (unlikely) devlopments occuring. The scenario might be less likely than scenario three and in addition it seems the downside from scenario four is less dramatic than upside from scenario three. Let’s say a few (reduced) dividends will be received and the company is still worth something (or between €10 and €20 to write down a number).

Scenario X

You might think there is a missing scenario: what if the current high trading activity will last for years to come (or even increase)? I don’t believe this is a plausible scenario, meaning I think it’s probability is very likely very small (<10%). If I thought otherwise, I would probably look at Lang und Schwarz (LUS GR) which is up 600% over one year and trades on a modest P/E multiple (but likely on extraordinarily high profits). As physicists and economists know: if something can’t go on forever it won’t. Regarding todays level of retail trading activity I think there are just too many reasons against it, pushing the likely long-term trends more towards other scenarios:

- people do other things after reopening

- remember going to a bar with friends?

- AND talking to them not tap tap tapping your smartphone

- I could be wrong here, maybe all younger people are just fine with their friends interacting more with their mobiles then with them!

- AND talking to them not tap tap tapping your smartphone

- remember going to a bar with friends?

- when the money is gone so will be the users (investors)

- again, I could be wrong (as always!): maybe the youngsters just minimize their costs of living (staying in their parents houses for longer) and keep on yoloying…

- trends and hypes come and go

- I blog a lot more since wfh

- when blogger/youtubers/etc have other things to do this could result in less trading ideas and less trades

- if/when storystocks disappear: who is interested in boring stocks / returns (10% ANNUALLY) anymore

- I blog a lot more since wfh

- regulation, regulation and regulation

- payment for order flow

- mobile apps & gamification

- risk classification / user education

- (young) investors realize that quick in-and-out trades

- usually result in losses, and

- only sometimes in profits

- which are taxable (smarter to Hide from the tax man could become a new trend…), and as the saying goes

- the bank always wins meaning

- users could realizes costs are indeed high

When sino AG (up 400%+ over 1 yr), which owns a stake in TradeRepublic, is classic first-level thinking to profit from the current retails trend (retail investors, neo-broker, …), then the

first derivative might be LUS, and

Tick TS might be a second derivative … (but hardly unknown though)

Overview

Based on my above scenarios, which should be directionally right, Tick looks rather attractive with 8% and about fairly valued with 10%. With negative German interest rates Tick’s potential intrinsic returns of 10% before tax might be just what to look fore (dividends do not Hide from the tax man).

A comparison

Comparing a new investment opportunity against an existing portfolio company might offer a helpful perspective. A perspective needed before adding it to your portfolio. It is also important for holding a smaller number of ‘better’ companies or more precisely better investments.

I already own shares of Flow Traders NV (FLOW NA) which is an innovative liquidity provider, earning profits for providing critical infrastructure services but mostly from the trading spreads. It had stellar results recently due to higher market volatility, earning EPS of €5.71 in Q1 2020) driving its net trading margins, but based on a conservative normalized annualized net income of ~ € 100m FLOW trades at a 14x P/E (vs Tick at 17x). Whereas Flow’s intermittently extraordinary high Q1 profits are driven by volatility, Tick’s profits are currently inflated as well by load-dependend contracts (and might be so for a while) but underlying earnings growth should be more stable. And could be expected from an IT service provider.

In contrast to tick TS, Flow has to retain earnings to maintain internal and external capital requirements for growth. Both companies benefit from long-term tailwinds. Flow benefits from an ongoing trend to passive investments namely ETFs and grows its ecosystem. Tick provides trading related software (~70 institutional clients, 2.2.2) and profits from low or non-existent interest levels and more people becoming investors. Tick profits from strong customer relationships and higher demand for (new) trading solutions.

Tick usually only invests /incurs development expenses if clients reimburse them but key person risk is higher for Tick with less than 30 employees.

I have to say, I like them both for their own reasons.

Some price/data points might be old. Flow started to rise with higher VIX.

Summary

For a growing quality business with strong tailwinds and good execution the current valuation does not look too expensive. Results for the current FY ending September 2021 will very likely be higher looking at various (below google) trends, if

i) regulation does not stop the practice of paying for order-flow very soon, and

ii) the stock market does not crash immidiately.

I bought a small initial position at €38.40 on Jan 26th (and in hindsight I should have taken a closer look back then in September).

Where might be the edge? The company is just very small with its current market cap of €37m and a limited number of shares. It’sjust too small for most funds to buy. In fact, I wonder if funds are even allowed to buy shares with this wide bid/ask spreads or would they have to fear regulatory/legal hassles.

!!! trading spreads are very wide !!!

(and the stock price keeped running away from me / higher)

I hope you enjoyed my post on Tick TS. Have a different view?

Update(s):

- Ad-hoc Jan 29, 2020: €0.55m one-time income from a contract(change) with a start-up

- Tick TS eschews half its (prior) claim from the contract with the start-up

- More new hires (link) indication for more growth

- (Scenario 3 more likely)

Further reads

GME – Erkunden – Google Trends

Great article!

I think an other (superior) bet on the change of investing behavior of Germans, if you don’t mind illiquidity, might be Berliner Effektengesellschaft (BFV) – (56.2% owner of Tradegate AG)

Some impressive numbers:

– Trading volume increased 33% p.a. from 2010 to 2020 for Tradegate.

– Relative share of Tradegate to Xetra in trading volume increased every year from 2.33% in 2011 to 17% in 2020 (14% in Jan ‘20 increased to 24% in Dec ‘20). Jan ‘21 ratio is 28.5%.

– BFV has an adjusted(EBIT-taxes) look through ‘20 P/E of 16

In my opinion, we see a structural change in investing behavior driven by low interest rates (stocks are ‘without alternative’). High trading costs disappear slowly (some brokers still take €90 per order while others take €1) and the younger generation is more educated and confident to take wealth creation into their own hands.

This development will benefit Tradegate and Lang&Schwarz(LUS), both for slightly different reasons. Tradegate is the cost-leader [3] while LUS locked in Trade Republic which is 90% of the volume of the LUS-Exchange and the fastest growing broker for now.[5] Both risk profiles are very different though, LUS has some other business units.

There is still a long way to go for Germans who store most of their wealth in checking accounts and insurance products. [1]

Maybe some politicians finally waking up and realize that stock ownership is necessary, because the state might not be able to provide enough for retirement. [2]

Why I’m so enthusiastic (clearly biased!) about BFV you might ask? I’m a shareholder of BFV and a big fan of the CEO and majority owner Holger Timm who created his own exchange (majority owned by Deutsche Börse) and transformed the German stock market. I would highly recommend reading the annual reports of the last 10 years and the annual general meeting presentation.[4]

Fyi, I’m a shareholder of BFV and LUS.

[1]https://www.dasinvestment.com/deutsche-geldvermoegen-wachsen-auf-71-billionen-euro/

[2]https://www.procontra-online.de/artikel/date/2020/10/neues-positionspapier-cdu-will-vermoegensaufbau-in-deutschland-staerken/

[3]https://finanz-szene.de/digital-banking/die-ing-diba-herr-baader-unsere-neobroker-und-der-einbruch-von-xetra/

[4]https://www.effektengesellschaft.de/ir/hv/hv2020/Hauptversammlung_BEG_mit_Rede_HT.pdf

[5]https://www.welt.de/finanzen/article224086728/Aktienboom-Ein-Volk-traeumt-vom-neuen-Reichtum.html

LikeLiked by 1 person

Thanks for your comment!

I agree with many of your points.

Obviously there are many options to play this trend, however, I believe if it turns out not exactly as expected, Tick TS is a very ‘defensive’ investment.

I have my issues with LUS (critical informations missing, systems have issues with higher vola, is TR really locked in forever? what if TR leaves or ‘dies’?)

I do strongly hope that German politics on investing do change for the better, but more important is how will it develop! For that I am not sure! (probably for worse, Riester II or sth. like that^^)

LikeLike

BFV GR could be interesting…

LikeLike

I agree with you regarding LUS! There are a lot of issues with management (evasive, no business owners, not forthcoming regarding earnings power of different business units).

I might have used ‘locked-in’ too liberal. LUS is for now the only exchange for TR (Tradegate as back-up if there are technical problems), but this can be reevaluated on a short term basis (seems annually, but not sure) as far as I know. According to the AGM, management seems ‘relaxed’ (whatever that means) regarding the future with TR.

Btw, I don’t think TR is a big contributor to LUS’ success at the moment. LUS earnings come from derivative issuing (30% according to last AGM) and OTC trading (LUS-Tradecenter, including wikifolio, etc.) mostly.

TR order-flow is very low margin most likely. TG didn’t want to pay kickbacks for such order-flow in the past. LUS also just mentions revenue in last press release regarding LS-Exchange, pointing to a lower margin business. [1]

Regarding TR, I don’t see a future for TR in the current form. The company finally forced the established players to lower fees and to introduce mobile apps. As soon as other players start to compete on fees and trading app, the high value customers of TR have no incentive to continue to subsidize the low value customer by being forced to trade on an inferior exchange.

Fyi, regarding the German broker market, Flatex raised guidance yesterday.[2] Flatex is a big partner, maybe the biggest of TG, directing most of their flow to TG 🙂 [3]

[1] https://www.ls-d.de/investor-relations/finanznachrichten/2021/404-lang-schwarz-aktiengesellschaft-rekordjagd-geht-weiter

[2] https://flatexdegiro.com/media/pages/investor-relations/news/4176d739ff-1612277010/210202-flatexdegiro_press-release_record-month_raising-guidance.pdf

[3] https://www.flatex.de/fileadmin/dateien_flatex/pdf/mifid/veroeffentlichung_top_5_handelsplaetze_flatex_de_geschaeftsjahr_2019.pdf

LikeLiked by 1 person

Thx for your comment.

Reg. LUS: I do not follow the company that closely. Important info is missing, wikifolio/derivatives are clearly important profit drivers! Technology seems not that good to me (TR switching to Tradegate on high vola days), and w/o more info I guess one should assume a high loss event (even if unlikely) is more likely than at other players (i.e. FLOW, which states not a single loss day in [FY period]).

Flatex could also be interesting. Thx!

I could imagine, the bigger TradeRepublic becomes, the more importan tto switch the default trading partner to a more stable operator.

More mobile apps is an argument for Tick.

In general I fear, that LUS’ earnings are not the most sustainable, but each months at current record levels is real value for shareholders!

LikeLike

LUS addendum:

For many days and various tickers I compared live executable quotes on TradeRepublic (TR, currently effectively from LUS) vs Tradegate (TG) quotes. Often the bid/ask spread on TR app was much wider than on TG! obviously a very profitable way to earn (or reap) money from TR users.

An app with a single option for the trade execution w/o a handy way to compare quotes is the natural place to earn this higher trading spreads. BUT: users could transition in the following ways

a. go groke and disappear –> bad for TR/LUS

b. invest/trade succesful and become richer, which makes it more likely longer-term that their wealthc increases a lot and they become more cost conscious, want a better platform (LUS outages with higher vol) –> upside limited / less extreme

c. continue with high trading activity and stay on TR app with current setting –> is that too likely? I do not know. But I do not want to bet on it, currently.

LikeLike

Yes the spreads are wider on LUS-Exchange (LUS-X) overall, esp. when the reference market is closed and/or in times of high volatility, compared to TG. But I consider a wide spread as very negative for the long-term outlook of LUS-X.

Keep in mind, wider spreads might not be a sign of increased profitability at the moment, but a necessity, resulting from mostly low-margin order-flow from TR.

TG had a variable cost per transaction of slightly more than €2 a couple of years ago, which should be closer to €2.2 now.

If you check yesterday’s transactions for LUS-X, the bottom quartile has an transaction-volume of less than €84. The median transaction was around €263.[1] It might be hard to turn a profit on these low volume orders. The average transaction on LUS-X was approx. €1500 per order in 2020, compared to TG of €6000.

To lower the spread, an exchange needs more (high quality) volume, but how to attract volume when the spread is not as competitive?

This dynamics are pretty much ‘winner takes all’. More volume lowers cost –) brings more volume –) etc.

One hope for LUS-X might be the growth of TR into high-margin volume/customer.

As mentioned in my last comment and you also touched on in yours ( see b.), the part of the customer base which becomes high-margin (larger orders) will be disadvantaged and subsidize the low margin customer by trading with TR and might go to an other broker.

To stop high-margin customer from leaving, TR could offer more options for trading venues.

This walled-garden approach of TR seems not sustainable as soon as other German brokers offer mobile apps and more competitive fees, negating TR’s current advantages.

To your point c, best to never underestimate inertia and lack of financial education (What are spreads? It just cost 1€ to trade on TR!).

[1] https://www.ls-x.de/de/download

LikeLiked by 1 person

True. Better to never underestimate anyone.

I.e. people gamble and don’t care about their losses, and might even see TR more as gambling than long-term wealth creation…

LikeLike