Softbank Group Corp. (Softbank, SBG) is/was a Japanese Telecom Company, turned Investment Company. Determining what was and what is Softbank is not easy…

Company Description

SBG was and still is active in the Telecommunications Industry. Nowadays its subsidiary Sprint operates in the US market and Softbank Corp (SBC) operates as a Japanese Telco. The latter IPOed (very successfully!) only recently. However, these Telco businesses did loose relative importance over time. SBGs strategy according to ist CEO Masayoshi San is nowadays more about selling off mature businesses (like the Telco Businesses) and using proceeds for funding growing companies. This can happen by direct investments or via Softbank Vision Fund (SVF), see below… Understanding Softbank is not easy! Since I do not want to start from scratch describing Softbank, you find some useful sources below…

- A very nice starting Point to read are some posts from Vitaly Catsenelson (whose content on contrarianedge.com I like very much).

- Also, a look at the IR Website from SBG helps a lot (Group Structure, latest presentation).

- Another value investing blog I like to follow is valueandopportunity. For Softbank there are the following articles: part1 (SVF), part2 (SOTP).

Indebtedness

Consolidated figures overstate the total amount of Softbanks (interest bearing) Debt. That is because Sprints (and some other) Debt is non-recourse for Softbank Group, thus if Sprint or some other borrowers/subsidiaries go bankrupt, SBG is not obliged to pay off (all of) their Debts/loans. Some of this Debt is nonetheless shown in SBGs consolidated numbers. Softbank Groups Net Debt is c. 45 bn USD, according to p23 of the finance section. Consolidated Numbers state about 119 bn USD; including about 37 bn USD from the Japanese TelCo (SBC) and c. 45 bn USD from Sprint.

Interest Cover

According to recent finance presentation (p 9) Softbank Group on a standalone Basis has interest expenses of about 200 bn JPY (c. 1.85 bn USD) per year, which is covered, at least in the short term, by dividend income of c. 270 bn JPY (mostly from Japan TelCo) plus other cash inflows (Distributions from SVF, asset disposals) annually. Additionally a Cash Position of 1,200 bn JPY provides some cushion.

Credit Risk

CDS (Credit Default Swaps) for insuring SFTB Debt against non-payment, currently trade at 220bp for 10yrs (170bp for 5yrs), indicating an OKish Credit Risk. Softbank just sold 7-Year bonds at a 1.38% interest rate to local retail investors

Debt Maturity Profile

Most of Softbanks Debt is coming due between 2020 and 2029, half of that in 2024 alone. Some Debt is only coming due in 2040 and some other is perpetual. Since many of SBGs Assets will not generate Cash Flows in the near future, I would prefer maturities more stretched into the future.

Assets

Softbank has many assets, listed and non-listed. (only numbers in SOTP section images updated at 16-Oct-2019)

Alibaba Stake

Masa’s Investment in Alibaba is outstanding in any way. Softbanks stake is currently 26% (p12), theoretically valued at 130 bn USD. However, Liquidation of its stake could imply significant tax issues.

Softbank Corp

According to p13 of finance section, Softbank owns 66.5% of the Japanese Telco, that is currently consolidated as a subsidiary. Theoretical value is c. 44 bn USD. Softbank receives significant dividend payments from the Telco.

Sprint

Softbank owns 84.2% (p14) of Sprint (S), currently worth c. 23 bn USD. S will likely merge with TMUS, but that is not a sure thing, yet…

Yahoo!Japan

Softbanks Yahoo!Japan stake (30.55%) is worth about 5 bn USD.

ARM (privaetly hold stake)

Softbank bought ARM (a chipmaker & -designer with a very strong Position in mobile computing devices) in July 2016 for c. 31 bn USD. Since then SFTB used 25% as an equity contribution into SFV. ARM is not listed anymore, thus there is no easy observable (quoted) Price for Softbanks ARM stake. But… When buying ARM there was a premium of 43% involved. That could indicate that purchase Price was more than fair value. Chip Industry (Phila Semiconductor Index, SOX) more than doubled since July 2016. Indicating that ARM could be of much more value today than in Mid 2016

Softbank Vision Fund

The Softbank Vision Fund (SVF) is special, in any way you look at it. To fully grasp its structure and ist financial payoff Profile / value for SBG is not easy, not to say impossible, since not all Information is publicly available. But, the most important Features seem to be: Softbank Vision Fund seems to be the largest VC or PE vehicle in history, dwarfing other comparable funds and leading to two possible narratives:

- Q1: Does this give SVF/SBG a comparative Advantage? The Story could go like this: SVF invests in Company A in a certain industry, as usually Masa convinces Comp A / its founder to take (much) more Money than initially looked for/needed. That is Kind of a commitment / war chest. Therefore, other potential Companies X, Y and Z will not enter this industry, fearing an expensive cash war with Comp A, limiting the competition to A and ensuring a big market share [winner takes all markets] and potentially big future profits, or

- Q2: Does Masa just over pay by a factor of X because he just has so much Money to spend? In this case it is only a matter of time since one realizes that SBG/SVF overpayed for its Investments…

SVF as Leveraged^2 Play for Softbank Group

SVF is kind of a two-times leveraged play for Softbank Group on the underlying Companies (Uber, WeWork, …, and others to come…). The reason is to be found in SVFs capital contribution structure. The size of about 100 bn USD consists of Equity (like) instruments and debt-like instruments. For the equity part, 28.1 bn USD came from Softbank, and 27.3 bn USD came from outside Investors. Debt-like, preferred Shares that are non-recourse to SBG, that have a coupon of 7% p.a. and get payed before the Equity instruments make up for a 44.6 bn USD contribution from outside Investors only. In effect, the payoff Profile is assymmetric for Softbank, comparable to some kind of a Long Call Option with the funded companies being the underlying asset. You can get an impression of the described leverage effect as of 30-Jun-2019 at p8 of SVF section or 35/94.

Management Fees

SBG will also receive management fees ranging between 0.7 per cent to 1.3 per cent of the capital committed, depending on each Investor (ft). Since the funds size is so huge, that could be an underestimated value contributor for SFTB. I just guess that costs to manage SVF are usually lower.

Performance Fees

As fund manager, SoftBank Group will retain roughly 20 per cent of returns over an 8 per cent threshold, a standard construct for operators of private equity vehicles (financial times). Kind of increasing the above mentioned leverage play.

Current Developments

Currently it looks like some of the Investments will not be (immediately) successful. Ubers IPO is widely believed to be not successful for investors. WeWork and the canceled IPO of its holding company The We Co. is currently critically discussed. The founder and CEO as well as several Family members were ousted, many critial aspects discussed during IPO process are finally addressed. A Cash Crunch is looming. The Valuation plummeted. A financing deal from SBG or JP Morgan will probably executed shortly.

SVF Summary

In conclusion, I believe SVF is contributing much value (mean value) to Softbank. However that value comes with a big amount of risk. Since the SVF is funded mostly with debt-like instruments (leverage), and the Performance of each underlying asset is also expected to be very volatile (big winners or losers), the possible paths for SVFs value is very scattered. Only time will tell if the SVF Investments will be a (huge) success or not. Currently, SVF II seems to run into some funding Problems…

Because of the recent development of WeWork / The We Co. I am willing to assign a lower value to SVF since SBGs equity stake could become worthless if the underlying investments or the biggest ones do very poorly.

NAV

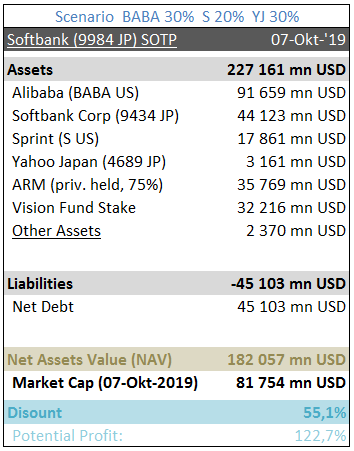

Below are several SOTP calculations with different assumptions applied, regarding Tax Issues (implied asset sale with taxes due) and Asset Discounts (i.e. to SVF).

The SOTPs yield NAVs in the range of 141 to 219 bn USD compared to a current Market Cap of 82 bn USD.

Quality Aspects

Risks

- Failing Sprint/TMUS Merger, Sprint challenged on standalone Basis

- Japan TelCo Business (i.e. margins) could be pressured by fourth National Network Operator (Rakuten) and thus Dividend payments to SFTB could be lowered LT

- General Downturn in PE/VC industry, negative development SVF, worsening Debt Ratios

Catalysts

Softbank could be valued higher by market participants in the future if either (i) the underlying assets are valued higher and/or (ii) the Discount to NAV shrinks. Since the whole Point of this article is using an SOTP as a short-cut for valueing a Company, I am not going to discuss (i), regarding (ii):

- IPO of SVF, sale of other assets (ideally in Tax-efficient way)

- Succesful Merger of Sprint/TMUS, and thus de-consolidation of Sprints Debt and beeing in ab better Position to sell some Sprint Shares

- Increasing the Dividend Payout (currently c. Yield of 0.9%)

- Acceleration of Share Buy back Programm should narrov the NAV-Discount. SBB Program of 600 bn JPY currently ongoing

Final Conclusion

Investing in Softbank Group comes with a substantial risk! I believe I am aware of the most material risks and I am willing to accept them. That is because I do not have any exposure to the PE/VC/Unicorn/NewTech/GigEconomy-Universe, yet.

At current prices, buying into SBG provides a significant discount to my calculated NAV values. Even compared to my lowest NAV* value (very pessimistic assumptions applied to SOTP Valuation) the discount to current Market Cap is >40%.

What I further like about the investment opportunity is the easy to understand valuation approach.

*) high tax charges applied to asset values of Alibaba, Sprint and Yahoo! Japan, implying asset sales with high tax charges payable; equity investment in SVF and Net Present Value of Management Fees as well as Performance Fees assumed to be zero.

In conclusion I bought an initial position in Softbank Group Corp shares (9984 JP) today (16-Oct-2019).

Best and happy investing!

Hi asyk77. Thank you very much for your kind words. (I believe it is the first comment for my blog, so all the more important for me)

They post their own calculation of net asset value and daily price per share on their website, so it is rather easy to conclude that it is cheap. But it pretty much depends on your adjustments one wants to make.

Best, s4v

LikeLike

Hi there,

Awfully hard to find such detailed analysis on Softbank, well done for the hard work put in. I knew it was cheap, but it was going up at such a rapid pace for the most of 2019, now that its down more than 30% from its peak, looks like there’s finally a buying opportunity, initiated positions on 24 and 25 October 2019. Pretty oversold from a technical analysis standpoint as well.

LikeLiked by 1 person

Oddball Stocks discusses an interesting issue when doing a SOTP Valuation: taking into account the net present value of corporate Overhead costs as a liability.

First, I guess, this is indeed one reason why Holding Companies (HoldCos) mostly trade at a Discount compared to SOTP.

Second, I guess, relativley speaking, this issue is of much higher (lower) relevance when valueing a Company with a low (very high) market capitalization, since managing twice as many assets does not require twice as many employees at the headqurter, or at least, it should not….

LikeLike

Aswath Damodaran with a post about Softbank and how the WeWork debacle affects the Softbank story…

http://aswathdamodaran.blogspot.com/2019/11/the-softbank-wework-end-game-savior.html?m=1

LikeLike

Nice Post by Valuesque about the related accounting when aquiring subsequent stakes of a company:

https://valuesque.com/2019/12/04/stepping-up-and-down-the-value-ladder-the-pars-pro-toto-financial-analysis-problem/

LikeLike